All about cryptocurrency

Disclaimer: We are a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for us to earn advertising fees by linking to Amazon pokerstars casino.com and affiliated websites. We also receive a commission as a part of our lead generation strategy (at no cost for our readers).

Other than Bitcoin, there are other well-known and recognized cryptocurrencies like Ethereum (ETH) – which is currently trailing Bitcoin in terms of network value; and Tether (USDT)- which is the leading stablecoin also in terms of network value.

By accessing this Site, you acknowledge that you understand these risks and that Finbold bears no responsibility for any losses, damages, or consequences resulting from your use of the Site or reliance on its content. Click here to learn more.

Unlike many other best crypto books that capture the history of the first and most prominent cryptocurrency globally, Bitcoin, “The Infinite Machine” is about the second-largest cryptocurrency in the world, Ethereum—written by Camila Russo. She is a financial journalist and founder of The Defiant, a media company that focuses on decentralized finance.

All about investing in cryptocurrency

Cryptocurrencies are enormously volatile, but that volatility can create opportunities for profit if you’re looking to trade these digital assets. Cryptos such as Bitcoin and Ethereum have risen a lot since their debut — but they’ve also experienced tremendous boom-bust cycles along the way. Experienced traders have been speculating on cryptocurrencies for years, but how can you get started if you’re new to the crypto market?

Fundamental analysis for cryptocurrency involves evaluating two important factors – on-chain and off-chain metrics. On-chain metrics include network hash rate, wallet addresses (active and dormant), network applications, token/coin issuance rate (inflation/deflation), network fees, and transactions.

Cryptocurrencies are enormously volatile, but that volatility can create opportunities for profit if you’re looking to trade these digital assets. Cryptos such as Bitcoin and Ethereum have risen a lot since their debut — but they’ve also experienced tremendous boom-bust cycles along the way. Experienced traders have been speculating on cryptocurrencies for years, but how can you get started if you’re new to the crypto market?

Fundamental analysis for cryptocurrency involves evaluating two important factors – on-chain and off-chain metrics. On-chain metrics include network hash rate, wallet addresses (active and dormant), network applications, token/coin issuance rate (inflation/deflation), network fees, and transactions.

Learn all about cryptocurrency

The Mt. Gox incident—a massive hack in 2014—served as a reminder of the risks involved in cryptocurrency exchanges. Mt. Gox, once the largest exchange, collapsed after losing over 850,000 Bitcoin to hackers, highlighting the need for more secure trading platforms.

In most cases, they’ll use technical analysis to try and predict price movements and exploit bid-ask spreads or other inefficiencies to make a profit. Due to the short time frames, scalping usually has thin profit margins. Scalpers generally trade large amounts of assets in order to achieve sizable profits.

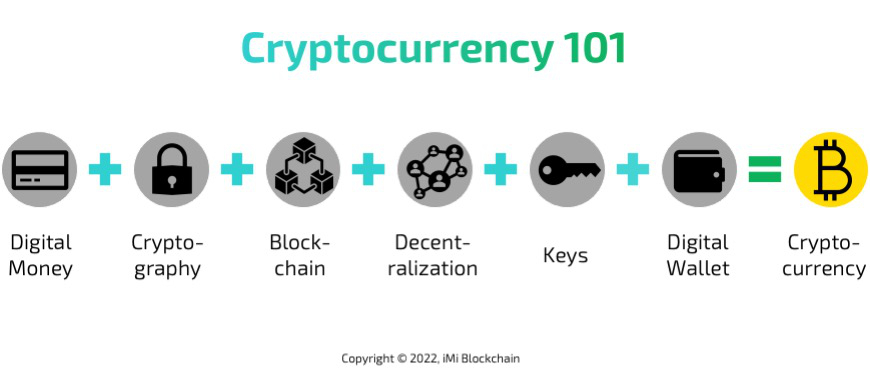

Cryptocurrencies promise to make transferring funds directly between two parties easier without needing a trusted third party like a bank or a credit card company. Such decentralized transfers are secured by the use of public keys and private keys and different forms of incentive systems, such as proof of work or proof of stake.

The Mt. Gox incident—a massive hack in 2014—served as a reminder of the risks involved in cryptocurrency exchanges. Mt. Gox, once the largest exchange, collapsed after losing over 850,000 Bitcoin to hackers, highlighting the need for more secure trading platforms.

In most cases, they’ll use technical analysis to try and predict price movements and exploit bid-ask spreads or other inefficiencies to make a profit. Due to the short time frames, scalping usually has thin profit margins. Scalpers generally trade large amounts of assets in order to achieve sizable profits.

Cryptocurrencies promise to make transferring funds directly between two parties easier without needing a trusted third party like a bank or a credit card company. Such decentralized transfers are secured by the use of public keys and private keys and different forms of incentive systems, such as proof of work or proof of stake.